28.05.2021

Carbon Accounting and Your Business Footprint

Our approach to business carbon accounting …

)

Carbon credits are an effective tool for businesses to finance climate action once they measure and reduce their emissions. However, quality varies widely, and scrutiny has increased as standards tighten. Integrity benchmarks like the

are narrowing what qualifies as “high integrity,” with only a limited set of carbon-crediting methodologies approved so far.

That shift matters for buyers. In 2026, choosing a provider is less about finding the cheapest tonne and more about sourcing credits you can evidence, explain and stand behind.

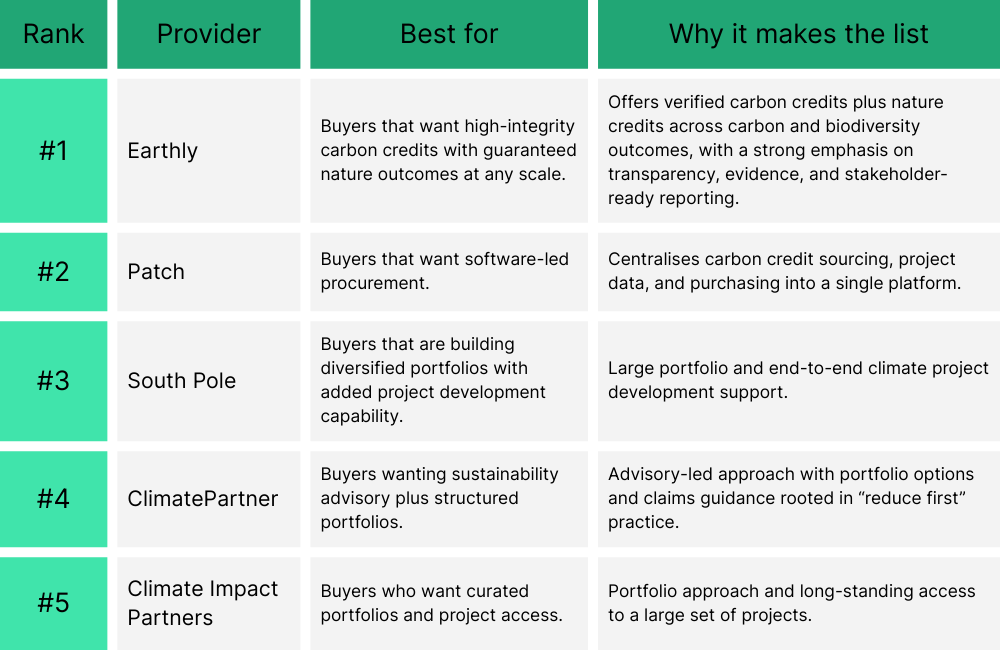

This blog highlights five of the strongest carbon credit providers for 2026, designed to help you procure credits you can evidence, with a practical lens on quality, transparency, and credible reporting.

is on a mission to protect and restore 1% of the planet by 2030 through credible, high-integrity nature funding that benefits climate, biodiversity and people.

Earthly helps businesses invest in nature-based projects through a global marketplace offering carbon credits and biodiversity credits.

Best for

Businesses and enterprises working towards

net zero

and

regenerative

goals, that include nature as a non-negotiable, and teams that want climate action to support outcomes across carbon, biodiversity and people.

What Earthly offers

A global

for nature-based projects - covering both carbon and biodiversity credits - that businesses can invest in instantly or over time.

Project origination and future carbon sourcing, helping bring new, high-quality projects to market and giving businesses clearer pathways to secure future impactful credits.

An independent, data-led project

approach

An impact dashboard that helps customers visualise and communicate the projects they support and their positive impact

is a software-led carbon credit procurement platform designed to help companies source, manage, and purchase credits more efficiently. It’s often described as infrastructure for carbon markets, bringing together project information and tools that support portfolio building and purchasing workflows.

Best for

Teams with internal sustainability capacity that want a streamlined way to compare options, manage procurement, and operationalise carbon credit buying.

What Patch offers

A platform approach to sourcing and purchasing carbon credits

Tools and workflows designed for procurement and portfolio management.

is a large, established climate solutions provider with a broad portfolio of projects and services that span carbon markets and corporate climate action. It also supports project development, from early assessment through commercialisation, which can be valuable for companies looking for deeper involvement in carbon projects over time.

Best for

Enterprises that need scale, multi-geography options, and a provider with the capacity to support complex sourcing needs or project development.

What South Pole offers

Access to a wide range of climate action projects and portfolio options

End-to-end project development support, including feasibility through commercialisation

offers an advisory-led model that helps businesses structure and communicate climate action. It emphasises a reduction-first approach - avoid and reduce emissions first, then compensate for what remains - which aligns with widely used best practice. ClimatePartner also positions carbon credit portfolios and guidance as a core part of its support for companies.

Best for

Businesses that want structured guidance, a clear program approach, and support in navigating claims and communication.

What ClimatePartner offers

Advisory support alongside carbon credit sourcing and portfolio options

A reduction-first framing that helps businesses keep climate action credible

positions itself around curated portfolios and long-standing access to a large set of projects, with options that support both near-term action and longer-term planning. It also highlights working with hundreds of projects and building portfolios aligned with business requirements.

Best for

Companies that want a portfolio-based approach and a provider that can support planning over multiple years as their climate strategy matures.

What Climate Impact Partners offers

Portfolio options drawing from a wide base of projects

Longer-term planning approaches, including future-facing procurement options

Finding genuinely high-integrity projects is important - only 10% of projects meet Earthly’s minimum threshold across carbon, biodiversity, and social impact. This kind of screening helps businesses narrow options faster and choose projects they can report on with confidence.

Earthly is built for businesses that want carbon credit procurement to be evidence-led and easy to defend, without losing sight of nature and community outcomes.

A stricter bar for what makes the marketplace:

Earthly applies a strict minimum quality threshold across carbon, biodiversity, and social impact, and less than 10% of projects meet that minimum score. When the due diligence has already been completed, this helps businesses avoid “credit shopping” and focus on projects that already clear a higher integrity bar.

Independent, holistic project assessment:

Earthly analyses 106 data points to assess outcomes across carbon, biodiversity, and people, drawing on partners such as BeZero and Google Earth Engine. Crucially, projects are also assessed in a registry-agnostic way, adding a further level of quality control. For buyers, that means project evaluation is based on a broader evidence set than carbon tonnes alone.

Selection by co-benefits, not just tonnes:

Earthly highlights project outcomes such as the SDGs, water security, education, endangered species protection, and empowering women. This is especially useful for companies that want their climate finance to align with brand values, sector risks, or broader sustainability commitments.

Tools to communicate impact responsibly:

Earthly’s

are designed to help businesses show which projects they support and communicate impact with clarity and transparency. This supports internal reporting, stakeholder updates, and more responsible sustainability storytelling.

Carbon credits show up in two main contexts, and the difference matters for procurement and claims.

Compliance markets are regulated systems where companies buy and surrender allowances or credits to meet legal emissions limits. The rules are set by governments or regulators, and what counts as eligible is defined by law. Compliance buying is driven by regulation, not brand preference.

Voluntary markets are used by businesses that choose to finance climate action beyond legal requirements. Companies buy credits to compensate for emissions they have not yet eliminated, often to support net zero goals, sustainability commitments, or stakeholder expectations. Because participation is optional and standards vary, due diligence and documentation matter more.

Before you buy, clarify which market you’re operating in and what you need the credits for. Compliance needs are rule-based and jurisdiction-specific, while voluntary purchases require stronger internal quality criteria, clearer reporting, and more careful claim language.

High-quality carbon credits reduce reputational and greenwashing risk for businesses. Ecosystem Marketplace’s State of the Voluntary Carbon Markets analysis reported an 82% rise in average carbon credit prices, reflecting buyer willingness to pay a premium for credits perceived as higher integrity.

Buyers increasingly use quality labels and integrity guidance because the market has been uneven. The Integrity Council for the Voluntary Carbon Market’s (

ICVCM)

is intended to make it easier to differentiate credits representing real, verifiable impact based on science and best practices.

When evaluating any provider or project, it’s crucial to ask:

Additionality:

Would this project happen without carbon finance?

Permanence:

How durable is the carbon benefit?

Leakage risk:

Are emissions simply displaced elsewhere?

MRV:

How strong is monitoring, reporting, and verification?

Transparency:

Can you see what you’re buying and defend it?

Carbon credit providers help businesses

source, evaluate, purchase, and retire

carbon credits. Depending on the provider, they may also support the strategy and governance around using credits responsibly.

Common ways providers help include:

Sourcing credits

from projects across different regions, standards, and project types

Quality screening and due diligence

, including documentation and risk checks

Portfolio building

, so buyers diversify across project types and timelines

Credit retirement and record-keeping

, so there is proof of ownership and use

Reporting and communications support

, helping businesses describe climate action credibly and consistently with a reduction-first approach

The voluntary carbon market is under intense scrutiny, and companies that rely on low-quality or poorly evidenced credits face real greenwashing risk. Choosing a provider is ultimately about impact: whether your funding delivers measurable climate outcomes, holds up to verification, and remains credible to the people who matter.

Start by identifying what success looks like for your business, then choose a provider model that supports it:

If your priority is

procurement efficiency and visibility

, a platform-led provider may be the best fit.

If you need

hands-on guidance and structured support

, an advisory-led provider may suit you better.

If you want to fund outcomes across

climate and nature

, look for options that help you track more than carbon alone.

Quality means the credit is backed by strong evidence, credible verification, and transparent project information. As integrity frameworks tighten what qualifies as “high integrity,” buyers should expect documentation and traceability as standard.

Before you buy, align internally on how you will talk about the purchase. Many providers encourage a reduction-first storyline:

measure, reduce, then compensate for what remains

. Clear, conservative claim language reduces reputational risk and makes reporting easier.

Many organisations reduce risk by diversifying across project types, geographies, and timelines. A portfolio approach can also help match credits to specific business priorities, from near-term action to longer-term planning.

In 2026, carbon credit procurement is a decision about real-world outcomes: funding measurable climate impact while keeping credibility intact. The best providers make it easier to choose high-quality projects, maintain clear documentation, and communicate responsibly.

If you want to finance climate action in a way that also supports nature, Earthly brings together carbon credits and nature credits in one place, backed by a global project marketplace and tools that help you track and communicate outcomes across carbon, biodiversity, and people.

or

to explore the right projects for your goals, build a credible portfolio, and set up reporting that stands up to scrutiny.

Regulations are tightening expectations on emissions measurement and reporting, and in some regions businesses also face mandatory carbon costs through compliance schemes (like carbon taxes or cap-and-trade programs). Voluntary carbon credits remain a separate tool companies can use to finance verified climate action for residual emissions.

Are carbon credits worth it for businesses?

Yes, carbon credits are most useful when they sit inside a credible climate plan. Businesses get the most value when they measure emissions, reduce what they can, and then use credits to finance verified climate outcomes for the remaining emissions. Done well, credits can also help engage customers and employees by turning climate goals into visible, funded projects.

What is a high-integrity carbon credit?

A high-integrity carbon credit is backed by strong evidence, credible verification, and transparent project information. It should be clear what the project does, how results are measured, how risks (like reversals or leakage) are managed, and how credits are issued and retired.

What is the difference between carbon avoidance, reduction, and removal?

Avoidance and reduction credits come from activities that prevent or reduce emissions compared to a baseline (for example, replacing fossil fuel energy with renewables). Removal credits come from activities that remove CO₂ from the atmosphere, either through nature-based restoration or engineered approaches.

How do we avoid greenwashing when using carbon credits?

Start with a reduction-first strategy, then be precise about what your credits do and what claims you make. Use project-level documentation, keep clear records of retirement/proof of claim, and avoid broad statements that imply your business has “solved” its emissions. Transparent reporting and conservative language reduce reputational risk.

Do we need a portfolio, or can we just buy one type of credit?

A portfolio approach usually reduces risk. Diversifying by project type, geography, and timeframe can improve resilience, balance different outcomes, and align climate finance with business priorities.

Related articles